A fixed-price contract is a type of contract where the payment amount does not depend on resources used or time expended.

Government buyers often use Fixed-price contracts to control the cost of a project and put the risk on the seller’s side. From a buyer’s perspective, there are some advantages and disadvantages to this. Here are just some of them.

Advantages and Disadvantages

Client Advantages

- Budgeting. The buyer budgets for the costs of the fixed-price contract up front thereby ensuring that it fulfills its end of the agreement and won’t face unexpected, additional costs

- Passing on Risk. If the costs of the project increase, the seller takes the loss (but see para. 4 below)

Client Disadvantages

- Higher initial cost. The seller is required to price risks over which they may have no control, and which may never happen

- Higher initial risk. If the seller does not price appropriately, the project may fail because the seller cannot absorb the increased costs

- Considerable time spent up-front on documentation and drawing up contracts

- Market Changes. A fixed-price contract ties a buyer in if the market changes. Any changes would be costly and outside of the budget

Despite their popularity, fixed-price contracts have a history of failed or troubled projects. For example:

- The Chief Executive of Airbus described the fixed-price contract for the A400M aircraft a disaster rooted in naivety, excessive enthusiasm and arrogance.

- The A-12 Avenger II contract had a target price of $4.38 billion. Rather than saving costs, it would consume 70 percent of the US Navy’s aircraft budget within 3 years so the program was cancelled.

- Boeing, the seller, absorbed cost overruns of $1.9 billion on the KC-46 Pegasus contract.

To summarise, the fixed-price model invites the seller to gamble on the unknown. Not only must they estimate the cost and time involved to meet the scope, they must add a contingency for unforeseen circumstances.

The Fixed-price Contract and Traditional Project Management

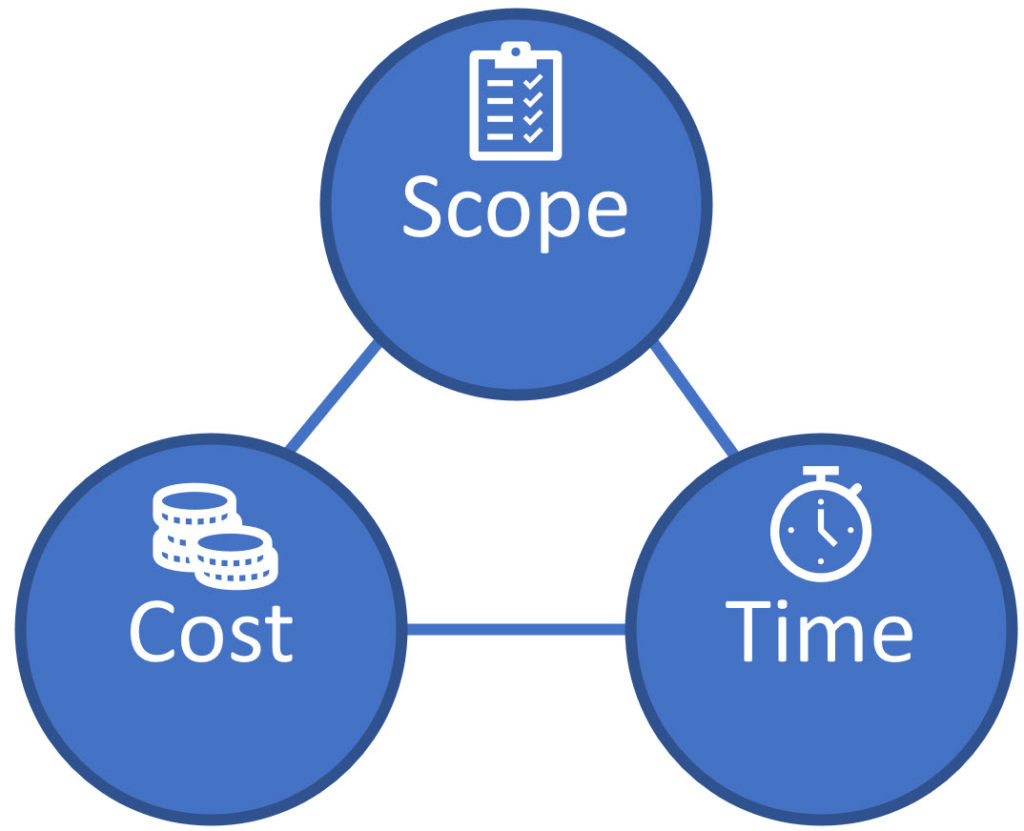

Project Management operates utlising the ‘Triple Constraint‘ model, sometimes referred to as the Iron Triangle. It says that cost is a function of time and scope and that these three factors are related in a defined and predictable way. If we want to shorten the schedule we must increase cost. If we want to increase scope we must increase cost or schedule.

However, the data says otherwise. The majority of projects that are over budget are also late. Projects that are both late and over budget also have a tendency to under deliver. This runs contrary to the constraint.

To summarise, the triple constraint model applied to a fixed-price contract adds a questionable model on top of a monumental gamble.

The Fixed-price Contract and Agility

Fixed-price contracts invite the seller to take a gamble on the future. Whenever I propose using agility to deliver on a contract, I start from the position that I cannot guarantee the future. I can make an estimate, but I cannot provide a guarantee. The inability to guarantee the future is an incontestable fact. This is a segue to offering a better approach than the Triple Constraint model.

I ask for flexibility on scope but offer to deliver work to within a second of the deadline, and to within a penny of the budget. I do this because the empirical data says that buyers WILL change their mind. Rather than charge for that under the old model, we’ll embrace the change.

If a buyer has flexibility in how a contract is offered, I mention:

- Quality is non-negotiable. We won’t compromise on it

- We don’t spend months on up-front documentation. All we need is enough detail to get started. We’ll build the plan as the product evolves based on the sellers needs

- We’ll deliver value after the first Sprint, and then every subsequent Sprint

- The seller is free to request changes at the end of each Sprint when we show the product

- The seller is free to stop development when they have what they want, even if we’re under budget

To summarise, I find that the fixed-price model can work with an agile approach when there is flexibility on scope. Fixed-price contracting is a gamble when there is no flexibility on scope. A gamble that might cost the livelihoods of you, your organisation and your employees. Is that really a gamble you want to take?

The Author

Derek Davidson, CST, PST authored this article. He delivers both Certified Scrum courses through the Scrum Alliance and Professional Scrum courses through Scrum.org. If you’d like to join one of his courses, checkout our course schedule.

We also have a special discount going during October. ‘Tenth month, 10% off’ Just use the code OCT10 during the checkout process if booking one of our October 2020 courses.

Leave a Reply